Fixed Rate Pay Items

If required, you may set a fixed rate for particular pay items. This enables the user to add this item to the payroll or a group of employees' pay items without entering it as a separate amount in each instance. Fixed Rate Pay items are useful for items such as meal allowances, petrol allowances and social club fees where a fixed rate is paid for each unit.

Creating a Fixed Rate Pay item

- From the navigator go to Company | Maintain company details | All Pay Items.

- Select the category of pay item you want to create.

![]() Note that you are only able to create Fixed Rate Pay items within the Taxation, Payment, Deduction, Leave Accrual, Leave Non Accrual and Non Cash pay item category.

Note that you are only able to create Fixed Rate Pay items within the Taxation, Payment, Deduction, Leave Accrual, Leave Non Accrual and Non Cash pay item category.

- Complete the details for the new pay item. For further information see "Creating a New Pay Item"

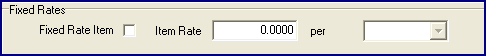

- When you reach this Fixed Rates field, complete the necessary information:

- Click on the Fixed Rate Item checkbox to select it.

- In the Item Rate field enter the amount that is to be paid or deducted.

- In the per field the measurement used for this pay item such as units, days, percentage will display automatically based on what has been entered.

![]() If the Fixed Rate Item checkbox is switched on then an Item Rate must be specified. If changes are made to the Item rate, then the system will pop up a confirmation screen as shown below. If you select Yes, HR3pay will process each of the tables referred to, changing the existing rate to the new rate.

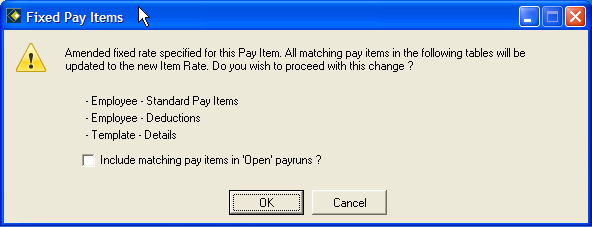

If the Fixed Rate Item checkbox is switched on then an Item Rate must be specified. If changes are made to the Item rate, then the system will pop up a confirmation screen as shown below. If you select Yes, HR3pay will process each of the tables referred to, changing the existing rate to the new rate.